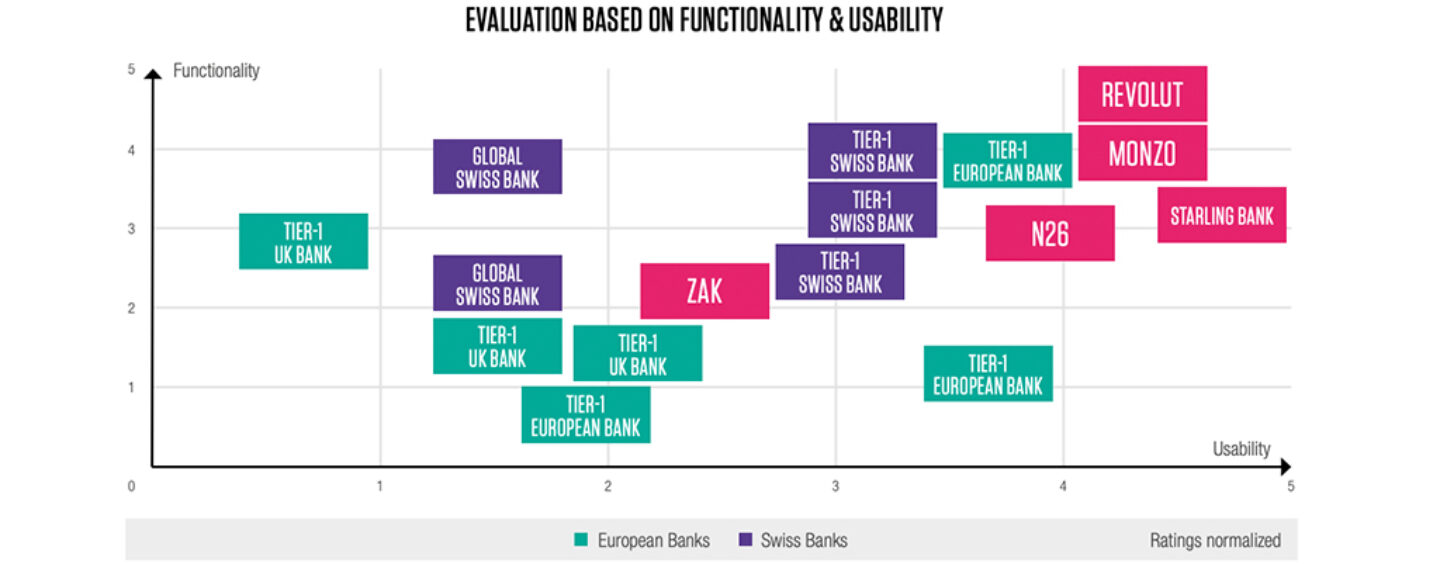

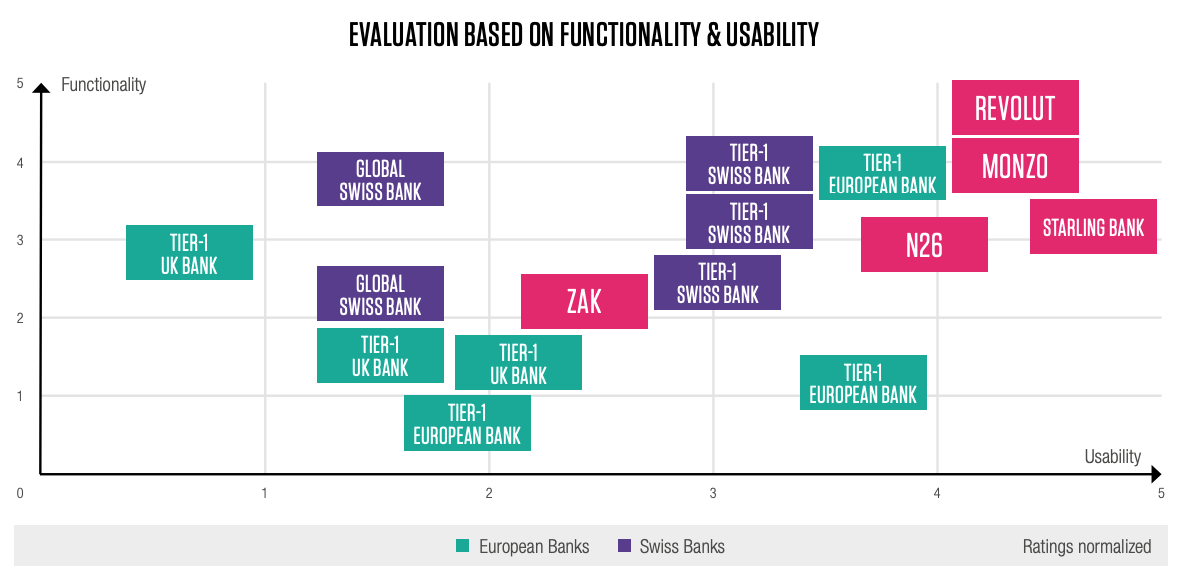

Challenger banks are setting new standards when it comes usability, and are championing features including card management and personal finance management, according to a new study by Capco.

The consulting firm, which analyzed the mobile banking offering of 16 financial institutions in Europe, found that challenger banks including N26, Starling Bank, Monzo and Revolut are outshining most incumbent banks on usability and user-friendliness.

Evaluation based on functionality and usability, Benchmarking Mobile Banking in Switzerland Today, Capco Digital Switzerland, February 2020

In particular, challenger banks offer a superior experience on mobile banking features such as notifications, which include the ability to not only receive information via push notifications but also interact with notifications to execute payments and authorize online purchases, but also asset management, card management, and personal finance management.

- via Benchmarking Mobile Banking in Switzerland Today, Capco Digital Switzerland, February 2020

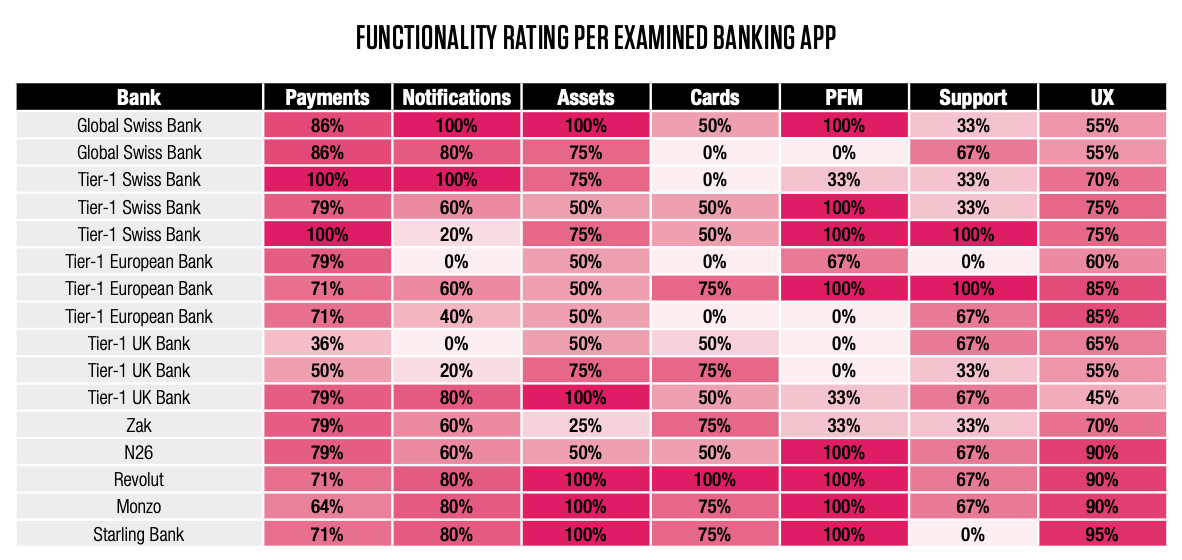

Going deeper into specifics, Starling Bank was found to be the financial institution providing the best user experience, followed by Monzo, Revolut and N26. The four also scored perfectly on personal finance management.

Functionality rater per examined banking app, Benchmarking Mobile Banking in Switzerland Today, Capco Digital Switzerland, February 2020

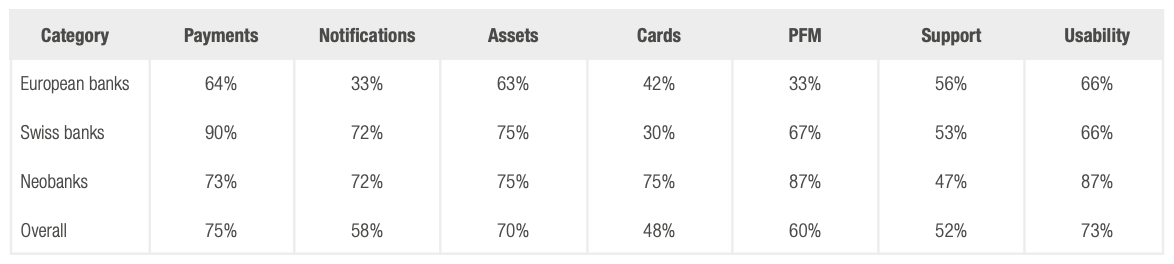

Swiss banks’ strengths and weaknesses

The research found that Swiss banks are overshadowing other European banks for payment functionalities, as well as coverage of personal finance management and notification features.

While Swiss banks might not provide the best user experience, the range of payment types supported and freedom to configure is very high compared to simplistic, SEPA-oriented functionality offered by mobile banking apps of other European banks.

As for personal finance management, Switzerland’s prime position is due to the feature being a standard for most Swiss banks, the report says.

Card management, however, was found to be their weak point. In fact, allowing customers to manage their cards through mobile banking apps was found to be the most neglected feature not only for Swiss banks but European banks altogether.

Overall, the research found that mobile banking is moving away from fully omnichannel-oriented strategies to more specialized approaches where apps do a few things but do them well. There is also a clear preference for native implementations for iOS and Android, which correlates with better functionality and usability, the report says.

Moving forward, it predicts significant investment into realigning mobile strategies to fit the functional scope that customers want, with usability being a key area of focus for its ability to drive retention and cross-sales.

To keep competitors at bay, the report advises incumbent banks to put in place a digital strategy that revolves around meeting customers’ evolving needs and allowing customers to interact with products and services via digital channels. Products should be made available immediately as part of a seamless onboarding process, and should be able to be consumed independently and flexibly.

Mobile banking in Switzerland

Mobile banking is still fairly nascent in Switzerland. More than half of digital banking customers in Switzerland don’t use the mobile app of their traditional brick and mortar bank, and of the ones that do, a few use the app regularly, the report notes.

Despite this, neobanks are rapidly gaining traction. Revolut said last year that it had signed up 250,000 customers in Switzerland, and at the end of 2019, Swiss mobile banking app Neon had 12,500. Neon however recently unveiled plans to scrap its fees to boost the number of clients to 250,000 within the next two years.

One other future Swiss Neobank to watch is Yapeal, one of our top picks of upcoming Hot Fintech Startups, Neon is also on that list.

Meanwhile, Germany’s N26 launched in Switzerland in September 2019, and had over 20,000 people signed up to its waiting list ahead of the public launch.

Zak, the mobile banking offering of Bank Cler, had more than 18,000 clients as of July 2019 and has a target of 200,000 users by 2021

Featured image credit: Unsplash